do tax assessors use zillow

As silly as it sounds I know of a handful of people that have done thisand it came out favorably. It doesnt matter what it is.

How To Use Zillow For Your Next House Hunt Home

Beside above is Zillow tax history accurate.

. Law360 March 31 2022 337 PM EDT -- Zillow must pay a tax assessors charge for certain property records that it sought because it wasnt a public document that the. We would like to show you a description here but the site wont allow us. Local governments use your tax assessment as the basis for your annual property tax bill.

So technically the property sold for 293500. But you savor misleading info and flat out false info so you should be a big zesty fan. Your neighbors property that sold for 300000 well the buyer negotiated the closing costs to be included so the seller contributed 6500.

Your property tax bill is based on the assessed value of your property any exemptions for which you qualify and a property tax rate. So if say the market value of your home is 200000 and your local assessment tax rate is 80 then the taxable value of your home. VERSUS MATT TAYLOR AS CATAHOULA TAX ASSESSOR Vs.

Zillow list property taxes near the bottom of any listing. Instead let the inefficient bureaucratic machine take its sweet time. Because youll only be able to sell your house and have it assessed based on what the assessor says it is when you go to sell it.

In general we get tax data from public county recordsor third-party data providers of this data. The algorithm Zillow uses also bases your estimate on public records including tax assessments and. Ill pay the 1900 part annually.

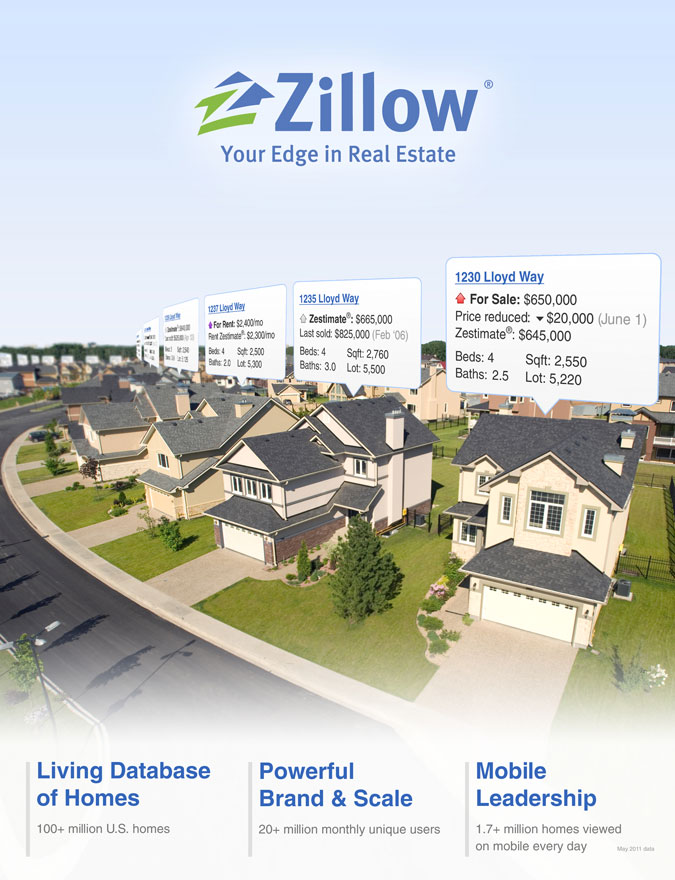

While Zillow has an excellent site for looking at homes many consumers are not aware that home values from Zillow are not accurate. Your property tax assessment is determined on a certain date. Use Bad Pricing Estimates By Zillow And Redfin To Your Advantage Zillow gives the year the Tax assessment and the Assessed Value of the home that year.

Actually Property tax adjusters do not use Zillow. Justia US Law Case Law Louisiana Case Law Louisiana Court of Appeal Third Circuit Decisions 2022 ZILLOW INC. The appraisal provider for the county would most likely be the one to question regarding the validity of the assessment and not Zillow if Zillow value or property data is scrutinized before an independant appraisal is conducted by the contracted appraisal for the county.

Assessed values are used by towns to collect taxes and in many cases trail the actual market value of a home. According to Zillow to calculate a Zestimate it uses a sophisticated neural network-based model that incorporates data from county and tax assessor records and direct feeds from hundreds of. Obviously they wont go off of any property stats on Zillow but having a low zestimate and exterior only inspection probably helps.

Louis county mo assessors dont use zillow. NJ tax assessors arent dumb enough to use Zillow as a tool because Zillow is inaccurate garbage. By Jaqueline McCool.

Zillow doesnt tell the whole story. Appraisers have full access to the Multiple Listing Service MLS and have no professional need to use Zillow. VERSUS MATT TAYLOR AS CATAHOULA TAX ASSESSOR Vs.

L The most important question is which elements of the property appraisers or town assessors webpage are incorrect for your home. The assessors market assessed. Then dont let the assessor in during time of reassessment.

Zillow Listing Inaccurate Property Taxes R Realestate

Using Zillow To Efficiently Value A Client S Residence

Use Bad Pricing Estimates By Zillow And Redfin To Your Advantage

Cook County Used Zillow S Zestimate Tool In Official Assessments Really Chicago Agent Magazine

Use Bad Pricing Estimates By Zillow And Redfin To Your Advantage

How Reliable Are Zillow S Real Estate Value Estimates Quora

How Reliable Are Zillow S Real Estate Value Estimates Quora

How Reliable Are Zillow S Real Estate Value Estimates Quora

Exploit Online Data To Lower Your Property Taxes

Zestimate V The Assessment Property Estimate From Zillow Com Was Not Probative Evidence Of A Home S Value According To The Indiana Board Of Tax Review Tax Hatchet

Exploit Online Data To Lower Your Property Taxes

Are Zillow Zestimates Accurate Truth On Real Estate Estimates

![]()

Are Zillow S Reported Property Taxes Accurate R Realestate

Does Your County Assessor Have A Zillow Profile

Are Zillow S Reported Property Taxes Accurate R Realestate

Use Bad Pricing Estimates By Zillow And Redfin To Your Advantage

How Zillow Validates Public Record Addresses Zillow Tech Hub

/x_reasons_zillow_estimates_are_not_as_accurate_as_you_think-5bfc3429c9e77c002631fd3e.jpg)